[ad_1]

- This evaluate incorporates associate hyperlinks. Read extra right here.

- Not an alternative to skilled veterinary lend a hand.

Health insurance coverage is the only factor in existence you wish to have however hope you by no means have to make use of: It’s the most efficient safeguard towards unexpected sickness, harm, and the entire different doable pitfalls of being alive.

For a rising collection of puppy insurance coverage consumers, the sentiment holds true for our cherished significant other animals. But the puppy insurance coverage area, which turns out so as to add extra firms and choices to make a choice from by way of the day, may also be complicated and overwhelming to navigate.

If you’re taking into account puppy medical health insurance however not sure of the place to start out your analysis, this text can lend a hand.

Over the ultimate 4 months, Rover carried out a chain of intensive surveys of shoppers with and with out puppy insurance coverage, exhaustive polls of puppy insurance coverage firms, and hours and hours of analysis to inspect the advantages, prices, and issues of puppy insurance coverage for the typical puppy mother or father. This article evaluates and compares 8 main firms that provide puppy insurance coverage.

Read on for regularly requested questions on puppy insurance coverage, a word list of recurrently used phrases, how we carried out the analysis, and to peer how every of the 8 firms profiled right here evaluate.

Click right here to skip forward to the listing of businesses and the way they when compared.

Our Top Pick: PetFirst

Getting top marks for carrier, buyer delight, and price, we rated PetFirst the most efficient general possibility for puppy insurance coverage according to the 8 firms we evaluate right here.

What Is Pet Insurance?

Pet insurance coverage is medical health insurance for pets, basically meant that can assist you pay sudden bills for sickness and harm. Similar to human insurance coverage, you’re making a per 30 days fee (known as a top class). Your veterinary bills will then be a minimum of partially reimbursed (that quantity differs by way of plan). Reimbursement usually begins after getting paid out a specific amount by yourself (the deductible).

The main points of what bills are coated can fluctuate very much, however in most cases, the elemental plan doesn’t duvet regimen vet visits and preventative care, reminiscent of once a year assessments, vaccinations, or spaying and neutering—simply wonder clinical bills. However, many firms additionally be offering add-on protection choices for regimen and wellness care.

Illness and harm protection is a big promoting level for our survey respondents. “My favorite part about having pet insurance is that I don’t have to panic about money when there’s something wrong with my dog,” says one puppy mother or father. Veterinary care at the present time is terribly refined and will deal with many extra diseases and stipulations than it might prior to now, however it may be pricey. While you could have limitless love in your puppy, you almost certainly don’t have limitless price range, and insurance coverage let you have enough money hospital treatment with out being worried concerning the expense.

The majority of businesses solely insure cats and canine; should you even have unique pets (birds, rabbits, reptiles, and so forth.) just one corporate in our survey, Nationwide, provides plans to hide the ones as nicely.

Click right here to skip forward to the listing of businesses and the way they when compared.

How Does Pet Insurance Work?

The price of puppy insurance coverage premiums are according to plenty of components that fluctuate relying at the corporate, however those usually come with the species and breed of the puppy, her/his intercourse, her/his age, and your location (for the reason that prices of veterinary care fluctuate somewhere else). Some firms be offering possible choices that customise protection for your wishes, which additionally impacts the associated fee: as an example, a plan that solely covers emergencies will price lower than one that still covers wellness care.

Your price will even rely on possible choices you’re making concerning the protection phrases. You could also be in a position to make a choice from a spread of deductibles (the volume it’s a must to pay for care prior to your insurance coverage corporate will get started paying you), a once a year or lifetime most payout, and money back fee, this is, what proportion of the invoice can be coated (as soon as your deductible is met).

As it’s possible you’ll be expecting, you get extra should you pay extra: A decrease deductible usually will price you a better per 30 days top class; a plan with a $5000 most payout will price lower than one with an infinite payout.

(Because of those complexities, no article can inform you precisely what your individual insurance coverage will price, because it relies on your own puppy, the place you reside, and what possible choices you’re making. However, for every corporate we attempt to provide you with some pattern prices.

Typically you’ll make your individual claims without delay with the insurance coverage corporate and be reimbursed without delay. Different firms have other strategies for submitting however at the present time they usually contain apps and/or on-line bureaucracy.

You can make a selection your individual vet, and all firms duvet emergency care, so it isn’t like human insurance coverage the place a commute to an out of community supplier in an emergency can grow to be a monetary calamity. Perhaps this is likely one of the causes that buyers usually appear to have a good angle towards their puppy insurance coverage. Some respondents to our survey made feedback like, “I’m just so in love with my insurer”—comments one hardly hears folks make about their very own medical health insurance.

However, there are some vital boundaries to pay attention to. The greatest one is that pre-existing stipulations don’t seem to be coated. You will wish to pay the whole price of deal with any drawback that used to be obvious prior to you bought your coverage. This is a transparent supply of frustration for purchasers, and disputes once in a while stand up over whether or not one thing meets the definition of “pre-existing.”

Also remember that like maximum human well being plans, maximum plans don’t supply protection for regimen dental care, which is unlucky since omitted dental care may end up in critical well being issues. Additional protection can once in a while be bought.

Beyond that, there are a large number of choices and variations, which may make it onerous to check firms and plans. This article will lend a hand with that, however remember to additionally take into consideration your individual scenario and do your individual analysis as nicely. It’s rather commonplace to peer on-line evaluations the place consumers are unsatisfied that their coverage didn’t duvet one thing when it used to be obviously one thing that the coverage they purchased didn’t duvet.

It’s simple to keep away from being that form of disenchanted buyer: know what you’re purchasing. Don’t think that one thing can be coated just because it’s one thing you recall to mind as hospital treatment, or is very similar to what your individual human medical health insurance covers—examination charges, say, or immunizations. Think about what’s vital to you and what issues your own puppy is vulnerable to, learn the corporate’s website online—some are slightly informative—and skim the real coverage. There are sufficient choices to be had in puppy insurance coverage at the present time that you’ll be able to most likely in finding one thing that can fulfill you, however don’t think that what your pal (or a piece of writing!) calls “best” is essentially easiest in your personal scenario.

Click right here to skip forward to the listing of businesses and the way they when compared.

Do I Need Pet Insurance?

Ask puppy homeowners about insurance coverage and one word comes up again and again: “Peace of mind.” Routine care, which isn’t coated by way of maximum plans, is a predictable expense that you’ll be able to funds for. But when confronted with an sudden sickness or harm, prices can balloon all of a sudden. Having insurance coverage approach you’ll be able to concern about your puppy moderately than the cost of care.

Even in case your puppy is recently younger and wholesome, it’s a good suggestion to believe insurance coverage previous moderately than later. Accidents, in fact, can happen at any age. And whilst older pets generally tend to wish extra care, some firms and plans have an higher age prohibit at which you’ll be able to start a plan.

All firms base the price of your per 30 days top class a minimum of partially at the age of your puppy. So in case your puppy is already older, your price can be upper. For an aged puppy, you could wish to believe extra sparsely whether or not the expense of a brand new insurance plans turns out price it, in comparison to placing apart the similar amount of cash in a financial savings account; alternatively, remember the fact that a financial savings account may also be tired, while an insurance plans would possibly finally end up paying out greater than you paid into it.

Also remember the fact that no plans duvet pre-existing stipulations. If your puppy already has a identified clinical factor before you buy your coverage, it’ll now not be coated. This is one more reason to believe acquiring protection when your puppy is younger and prior to any long-term issues have evolved.

If you could have a breed that might need remedy for a breed-specific hereditary or congenital drawback—say, airway surgical operation for a French Bulldog—you will have to make a selection your plan specifically sparsely, as a result of now not all plans duvet this. Be conscious that even the plans that do duvet congenital and hereditary stipulations will nonetheless now not duvet them if they’re pre-existing. What does that imply? Even despite the fact that a congenital situation is by way of definition one this is provide at beginning, what issues is whether or not the puppy has proven proof of the issue prior to the coverage is going into impact—signs of the situation, as an example, or a real prognosis. If so, it’s preexisting, and now not coated.

If your money drift scenario could be very tight, remember that payout instances fluctuate; firms cited a spread from 3 to seven days to over 3 weeks. So if speedy repayment is vital to you, be aware of this element when opting for a plan. One corporate, Trupanion, provides speedy repayment in case your veterinarian makes use of their proprietary instrument; with different firms you might also be in a position to select direct deposit as an alternative of having a take a look at mailed, which will even pace issues up.

Click right here to skip forward to the listing of businesses and the way they when compared.

Glossary of Commonly Used Pet Insurance Terms

Benefits: Full or in part coated services and products and coverings supplied by way of your puppy insurance plans.

Deductible: The amount of cash set by way of your puppy insurance coverage corporate for supplied services and products that should be paid out of pocket prior to your puppy insurance coverage plan pays for services and products.

Exclusions: Provisions on your puppy insurance plans that exclude protection for sickness or harm, for causes defined on your coverage.

Payout: The amount of cash paid to you as soon as a declare has been licensed and processed.

Pre-existing situation/s: Health stipulations on your puppy that exist or are obvious prior to you carried out for puppy insurance coverage which might be virtually by no means coated by way of puppy medical health insurance (not one of the firms profiled right here, as an example, be offering this sort of protection).

Premium: Your per 30 days fee in your puppy insurance plans.

Waiting duration: The period of time that should elapse prior to your puppy insurance plans is going (or portions of your coverage move) into impact.

How We Reviewed and Compared Providers

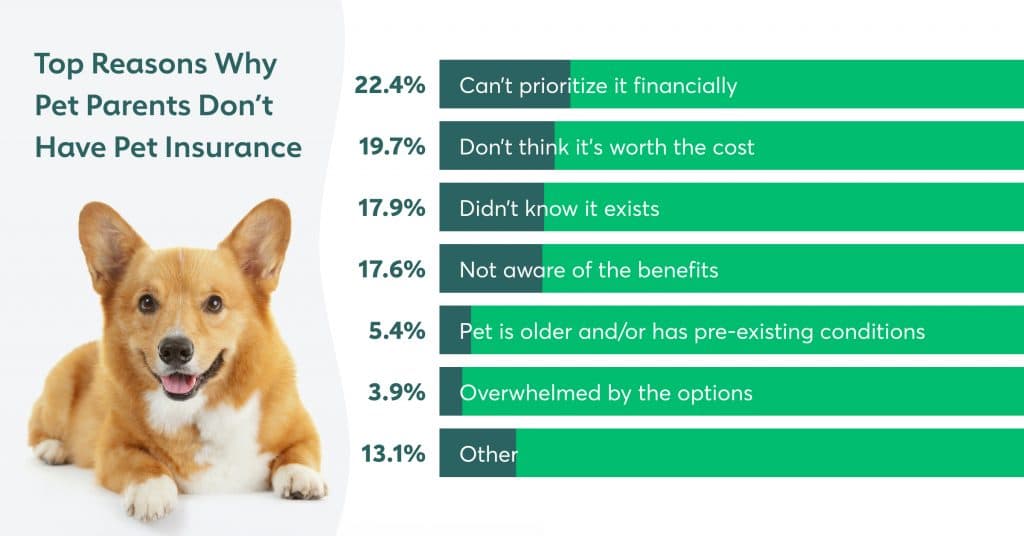

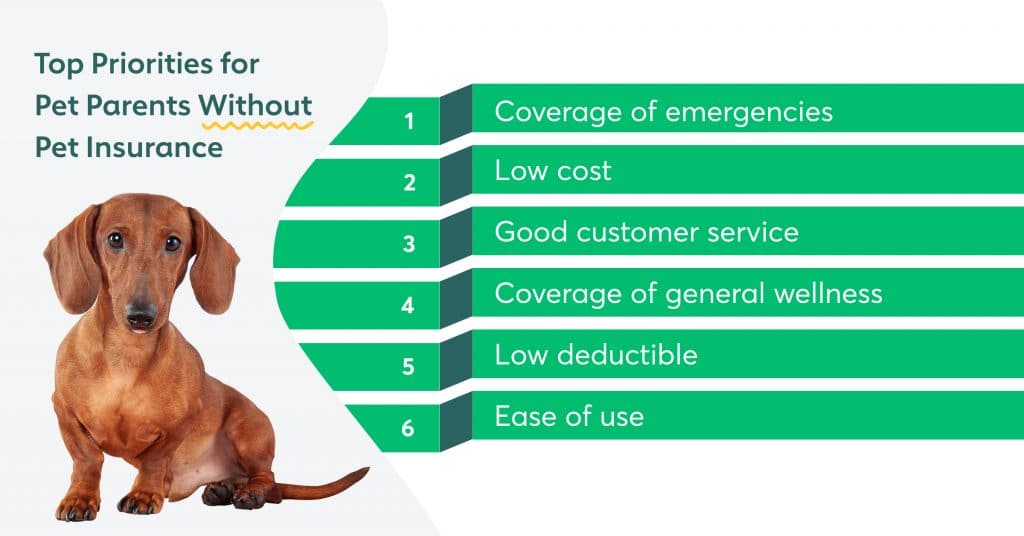

To resolve the most efficient puppy insurance coverage, we first polled Rover body of workers keen to proportion their revel in with puppy insurance coverage. Then we surveyed, by way of a 3rd birthday party polling platform, roughly 2,000 contributors for his or her revel in with puppy insurance coverage.* We then polled a an identical set of puppy folks with out puppy insurance coverage.

Next, we despatched an exhaustive shape inquiring for particular plan data to the highest 10 puppy insurance coverage suppliers within the country—Embrace, Trupanion, Nationwide, ASPCA, Petplan, Pet First, Figo, AKC, Pets Best, and Healthy Paws—and of those, Embrace, Trupanion, Nationwide, ASPCA, Petplan, Pet First, Figo, and AKC answered to our requests for plan data.** This article compares the qualities of the ones 8 firms.

We took this huge set of corporate and buyer information after which when compared it to current on-line public evaluations and the corporate’s general trade score; this helped us broaden a rating machine throughout the lens of the next standards:

- Overall buyer delight with the plan

- General buyer delight with plan price

- Quality of shopper carrier

- Ease of use of plan

The firms indexed underneath every are classified in keeping with how they when compared when all the ones qualities have been thought to be in combination.

The Best Pet Insurance Companies: Our Comparative Review

Our Top Pick: PetFirst

Getting top marks for carrier, buyer delight, and price, we rated PetFirst the most efficient general possibility for puppy insurance coverage according to the 8 firms we evaluate right here.

About the corporate

PetFirst used to be based in 2004 and used to be bought this 12 months by way of MetLife, a big company that gives insurance coverage and different monetary services and products. According to their website online, PetFirst has supplied insurance coverage to tens of 1000’s of canine and cats since their inception. Over 15 years of historical past and the backing of a big monetary company make this a forged selection for revel in and most probably long term balance.

What they get proper

PetFirst comes out at or close to the highest of our survey on questions on how most probably consumers are to counsel it to others—a sign of normal delight—and the way strongly they really feel that they get price for his or her cash. Comments on customer support are enthusiastic and use phrases like “caring” and “compassion;” one commenter says they “truly care about the wellbeing of my animals.” While their pace of repayment is solely middling, they usually don’t recently have an app for filing claims, they do be offering different on-line choices, and commenters appear glad with the convenience of the method.

What units them aside

While getting top marks for delight and price, their common top class prices are at the low finish of businesses incorporated right here. Exam charges and prescriptions are coated, and you’ll be able to acquire further protection for wellness care. They duvet hereditary and congenital stipulations, even if be aware that there’s a longer wait duration prior to protection kicks in for positive orthopedic stipulations (see underneath).

Plan at a look

- Any age restrictions: No

- Effect of puppy age on top class will increase: No particular resolution, however age is one issue that determines top class price

- Cost per 30 days: Plans get started at $15 for canine and $nine for cats. The corporate didn’t supply a mean, however a mean of pattern quotes used to be $15 for cats and $30 for canine

- Most commonplace explanation why a declare is denied: Pre-existing situation; declare is lacking data

- Average payout time: 80% of claims are processed in 10 days or much less

- Dental coated? Routine dental cleansing isn’t coated, solely remedy of periodontal illness

- Alternative therapies coated? Yes

- Waiting duration for protection to take impact: Accident protection starts in the dark; ready duration for sickness, 14 days; for stipulations reminiscent of Intervertebral Disc Disease (IVDD) and cruciate ligaments, six months

- Free telehealth services and products introduced? No

- General wellness and/or annual assessments coated? Additional protection may also be bought

- Exam charges coated? Yes

- Senior, army, pupil reductions? No

- Lifetime most payout: No most

- Maximum annual payout: Available possible choices come with an infinite plan

- Multi-pet cut price? Yes

- Claims procedure: Claims may also be submitted by way of on-line portal, electronic mail, fax, or same old mail

PetFirst is legally obligated to state the next: Independence American Insurance Company (“IAIC”) is the insurance coverage service for this product. PetFirst Healthcare, LLC, a MetLife corporate, is the coverage administrator approved to supply and administer puppy insurance coverage insurance policies. Independence American Insurance Company, a Delaware insurance coverage corporate, is headquartered at 485 Madison Avenue, NY, NY 10022. For prices, whole main points of protection and exclusions, and a list of licensed states, please touch PetFirst Healthcare, LLC. Like maximum insurance coverage insurance policies, insurance coverage insurance policies issued by way of IAIC include positive exclusions, exceptions, discounts, boundaries, and phrases for protecting them in drive.

Also Great: AKC Pet Insurance

With persistently top marks according to price and the way most probably consumers are to counsel it, AKC Pet Insurance is any other nice possibility for puppy insurance coverage from a emblem with a protracted historical past with pets.

About the corporate

Founded in 2002 as PetCompanions, Inc. and doing trade because the AKC emblem since 2003, they provide a spread of choices to customise your plan along with the extra standard possible choices of payout limits and deductibles. The base plan covers sickness and harm, and you’ll be able to acquire further protection for examination charges, hereditary stipulations, wellness/preventative, and dental.

What they get proper

Like PetFirst, AKC Pet Insurance will get persistently top marks in our buyer survey for a way most probably their consumers are to counsel it, and the way strongly they really feel that they get price for his or her cash. The greatest distinction between the 2 is just that we had a ways fewer respondents who have been their consumers, so the numbers could also be statistically much less dependable; alternatively, if the ratings became out to be constant over a bigger pattern, AKC Pet Insurance would possibly in truth pop out on most sensible.

Their top class for fundamental protection is likewise on the low finish of businesses surveyed—the typical over our asked pattern quotes used to be $12 for cats and $21 for canine. (The common equipped by way of the corporate underneath is possibly upper since that would come with consumers who’ve bought further protection, reminiscent of for wellness or congenital stipulations).

What units them aside

One merit over our most sensible pick out that would possibly subject to a couple consumers is they do have an app for filing claims. One downside is that protection for older pets (nine and up) is extra restricted. Respondents gave the impression similarly glad with the carrier.

Plan at a look

- Any age restrictions: Pets newly enrolled at nine or older can solely get accident-only protection. Inherited and Congenital protection should be added prior to age 2 and SupportPlus (covers cremation and burial bills) prior to age five

- Effect of puppy age on top class will increase: Age does issue into top class price, even if premiums would possibly both build up or lower with age relying on adjustments within the different components

- Average price per 30 days: $30–$50 per 30 days for canine and $20–$40 per 30 days for cats

- Most commonplace explanation why a declare is denied: Claim for one thing that’s not coated.

- Average payout time: 3 to seven days

- Dental coated? $150 repayment for dental cleanings with the extra DefenderPlus wellness care protection

- Alternative therapies coated? Alternative and holistic therapies are incorporated within the twist of fate and sickness base plan protection

- Waiting duration for protection to take impact: 14 days for diseases, two days for injuries, 180 days for Intervertebral Disc Disease (IVDD) and cruciate ligament stipulations. Supplemental plans have their very own ready classes, eg. 30 days for Hereditary protection

- Free telehealth services and products introduced? Yes

- General wellness and/or annual assessments coated? Covered with the extra Wellness Care plan

- Exam charges coated? Covered with the extra Exam Care plan

- Senior, army, pupil reductions? None discussed particularly, however reductions for accountable breeders are to be had

- Lifetime most payout: No most

- Maximum annual payout: Can make a selection annual prohibit from $2,500 to limitless

- Multi-pet cut price? Yes

- Claims procedure: App

Best for Fast Payouts: Trupanion

Trupanion is a longtime corporate with a protracted monitor report, and a really perfect puppy insurance coverage possibility for many who need a speedy payout: If your vet participates, their proprietary instrument can reimburse your declare in as low as 5 mins.

About the corporate

Trupanion used to be based in 2000 and claims to have paid out over $1 billion for clinical claims for 1000’s of pets, so that is a longtime corporate with a protracted monitor report. If a quick payout is your most sensible precedence, make a selection Trupanion and the proper vet: If your vet participates, their proprietary instrument can reimburse your declare in as low as 5 mins at checkout.

What they get proper

Trupanion states that they are going to by no means penalize or cancel protection for submitting claims. They duvet hereditary and congenital stipulations. While we’ve fairly fewer respondents with this insurance coverage, a big majority of them say they might counsel it.

What units them aside

Instead of an annual deductible, Trupanion’s deductible is, in keeping with the website online, “per-condition (as opposed to an annual deductible).” So, if you meet your deductible for one situation, you by no means need to pay it once more, which they are saying is exclusive within the trade; this might be precious in case your puppy develops a prolonged situation.

While many different firms generally tend to emphasise the variability of customizable choices they provide, Trupanion touts their “one simple plan.” While they do be offering a collection of deductibles, they simply be offering one repayment fee, 90%. They do additionally be offering a few types of further protection, reminiscent of for choice medication, however now not wellness care. If you’re feeling crushed by way of possible choices and need simplicity, Trupanion could also be find out how to move.

Plan at a look

- Any age restrictions: Can join pets from beginning till their 14th birthday

- Effect of puppy age on top class build ups: None; fee adjustments decided by way of adjustments in the price of native vet care

- Average price per 30 days: $50 for canine and $25 for cats

- Most commonplace explanation why a declare is denied: Pre-existing stipulations

- Average payout time: 7 days, however in hospitals with their proprietary instrument, as low as five mins

- Dental coated? Only twist of fate or sickness

- Alternative therapies coated? Yes

- Waiting duration for protection to take impact: five days for injuries and 30 days for sickness

- Free telehealth services and products introduced? No

- General wellness and/or annual assessments coated? No

- Exam charges coated? No

- Senior, army, pupil reductions? No

- Lifetime most payout: No most

- Maximum annual payout: No most

- Multi-pet cut price? No

- Claims procedure: Online declare shape

Trupanion is legally obligated to state the next: Terms and stipulations practice, please see Trupanion.com for complete protection main points. Policy choices and main points range by way of state, please evaluate your state’s particular protection. Trupanion is a registered trademark owned by way of Trupanion, Inc. Underwritten in Canada by way of Omega General Insurance Company and within the United States by way of American Pet Insurance Company.

Easiest to Use App: Figo

With its intuitive and multipurpose app, Figo stands proud for many who price technological answers and repair in a puppy insurance plans.

About the corporate

Figo used to be based in 2015, so it’s a relative newcomer in comparison to one of the vital different firms in our survey. Policies are underwritten by way of Independence American Insurance corporate, a part of Independence Holding Company, which used to be shaped in 1980. Their plans duvet injuries and sickness, together with hereditary, congenital, and persistent sickness, in addition to holistic therapies, however they don’t be offering wellness protection.

What they get proper

While we’ve fairly fewer respondents with this insurance coverage, the bulk are glad with the worth and feedback concerning the carrier are sure. The common price of premiums quoted used to be within the center vary.

What units them aside

Their Pet Cloud app for filing claims makes use of an AI chat bot, Evie, that lets you retailer and get right of entry to vet data, supplies 24/7 get right of entry to to veterinary recommendation, and has a reminders serve as; it has a social platform that permits you to hook up with different puppy folks within sight in addition to different location-based options that assist you to in finding within sight pet-friendly puts, eating places, canine parks, and different puppy services and products.

Plan at a look

- Effect of puppy age on top class will increase: No resolution supplied, however age is likely one of the components figuring out top class price

- Average price per 30 days: $40 canine, $20 Cats

- Most commonplace explanation why a declare is denied: Wellness declare, which isn’t coated

- Average payout time: seven to 10 days

- Dental coated? Yes, if associated with injuries

- Alternative therapies coated? Yes

- Waiting duration for protection to take impact: three days injuries, 14 days sickness, 6 months knee issues

- Free telehealth services and products introduced? Yes

- General wellness and/or annual assessments coated? No, however examination rate protection may also be added as an non-compulsory upload on

- Exam charges coated? Optional protection may also be bought

- Senior, army, pupil reductions? No resolution supplied; in keeping with their website online, to be had reductions range by way of state

- Lifetime most payout: Choice of $100Okay/$150Okay/limitless

- Maximum annual payout: Choice of $five,000Okay/$10,000Okay/limitless

- Multi-pet cut price? Yes

- Claims procedure: App

Best for More Than Just Cats and Dogs: Nationwide

We rated Nationwide as the most efficient for extra than simply canine and cats, because the supplier is the one corporate amongst the entire manufacturers right here that along with cats and canine covers unique pets reminiscent of birds and reptiles.

About the corporate

Nationwide has been within the insurance coverage trade for 90 years and has been providing puppy insurance coverage since 1981, the longest of all in our survey. They declare to have insured extra pets than some other, and to be the one corporate in america that provides protection for birds, rabbits, reptiles and different unique pets.

What they get proper

Nationwide provides a fairly fast payout time. Their Whole Pet with Wellness plan is likely one of the maximum complete to be had. Comments about buyer services and products are usually sure and an overly top proportion of our survey respondents really feel they get price for what they pay.

What units them aside

The obtrusive factor that units Nationwide aside is that they provide protection for pets rather than cats and canine. Since additionally they be offering a multi-pet cut price, when you’ve got each exotics and cats or canine, it will make sense to insure your entire pets with them on the identical time. Be conscious that solely the Whole Pet with Wellness plan provides complete protection for hereditary stipulations.

Plan at a look

- Age restrictions rely on collection of plan: minimums are eight or 10 weeks; the higher prohibit for his or her Major Medical is 10, no higher age prohibit for Whole Pet plan

- Effect of puppy age on top class will increase: Most plans begin to build up from age three

- Average price per 30 days: Dogs: $60 Cats: $35 Avian: $15 Exotic: $20

- Most commonplace explanation why a declare is denied: Pre-existing situation or incomplete data submitted

- Average payout time: Less than 5 days

- Dental coated? If you select the Whole Pet With Wellness plan

- Alternative therapies coated? Acupuncture, therapeutic massage, bodily treatment and different holistic and choice care supplied by way of an authorized veterinarian are coated

- Waiting duration for protection to take impact: 14 days

- Free telehealth services and products introduced? Telehealth services and products are coated underneath administrative center examination/session protection. Also contains get right of entry to to a 24/7 on-line carrier staffed by way of veterinary pros

- General wellness and/or annual assessments coated? Available relying on plan

- Exam charges coated? Yes

- Senior, army, pupil reductions? five% cut price for memberships together with AAA and AARP

- Lifetime most payout: No most

- Maximum annual payout: Depends on plan: No most annual payout for the Major Medical plan; Whole Pet with Wellness plan, $10Okay

- Multi-pet cut price? five% for 2 or 3, 10% for 4 or extra

- Claims procedure: App and on-line portal

Best for Additional Types of Coverage: Petplan

Beyond conventional puppy insurance coverage insurance policies, Petplan provides protection for issues reminiscent of boarding charges (if the landlord is hospitalized), promoting and rewards for misplaced or stolen pets, lack of a puppy because of robbery or straying, and extra.

About the corporate

Petplan used to be based in 2003. Policies are underwritten by way of XL Specialty Insurance Company. They supply puppy medical health insurance to over 200,000 consumers in North America. They don’t be offering wellness protection.

What they get proper

Petplan is the insurance coverage provder that covers the most important collection of respondents in our survey. The majority really feel that this can be a just right price. Hereditary and congenital stipulations are coated, in addition to behavioral.

What units them aside

Petplan provides protection for issues along with well being care, together with as much as $1000 in step with 12 months for boarding charges for if the landlord is hospitalized, promoting and praise for misplaced or stolen pets; lack of a puppy because of robbery or straying, demise from harm or sickness, and holiday cancellation if a puppy calls for lifesaving remedy.

Plan at a look

- Any age restrictions: Newly enrolled pets age 10 and older could have restricted repayment choices to be had

- Effect of puppy age on top class will increase: No resolution supplied; age is likely one of the components that resolve top class price

- Average price per 30 days: The corporate didn’t supply a mean, however the common of asked pattern premiums used to be $18.25 for cats and $40.14 for canine

- Most commonplace explanation why a declare is denied: Claim for wellness care, which isn’t coated

- Average payout time: 22 days

- Dental coated? Yes if for dental harm or sickness “and all conditions pertaining to dental coverage have been met.”

- Alternative therapies coated? Yes

- Waiting duration for protection to take impact: 15 days for accidents and diseases; six months for cruciate ligaments and hip dysplasia, until you get vet certification that the puppy’s knees are wholesome inside the first 30 days.

- Free telehealth services and products introduced? Telehealth services and products reimbursed as much as 1K every year for coated accidents and diseases and not using a deductible or copay carried out

- General wellness and/or annual assessments coated? No

- Exam charges coated? Yes

- Senior, army, pupil reductions? Discounts for AARP; Military and veterans; clinical services and products pets

- Lifetime most payout: No most

- Maximum annual payout: Between $2,500 and limitless to be had

- Multi-pet cut price? No

- Claims procedure: App

Best for Congenital and Hereditary Conditions: Embrace

Embrace Pet Insurance rose to the highest when it got here to protection for congenital and hereditary stipulations and for a fairer-than-average definition of curable and incurable stipulations.

About the corporate

Embrace used to be based in 2003. They pleasure themselves on how consumers can personalize their insurance policies, and level to their “diminishing deductible” characteristic: every 12 months a buyer is going with out being reimbursed for a declare, their deductible is lowered by way of $50.

What they get proper

While we’ve fairly few respondents which might be consumers of this corporate, the vast majority of them really feel they get price for his or her cash and appear glad with the client carrier. They duvet behavioral stipulations. Additional choices for wellness are to be had.

What units them aside

Every coverage covers congenital, hereditary, and breed-specific stipulations, they usually pleasure themselves in this to the level of together with related proprietor tales on their website online. While our survey didn’t ask about this, I discovered plenty of folks in an internet brachycephalic canine homeowners’ workforce who showed that Embrace had coated more than a few types of airway surgical operation for his or her canine. While no corporate covers pre-existing stipulations, they are saying their definition is fairer, distinguishing between curable and incurable stipulations: after 12 months and not using a signs or remedy for a curable situation, long term occurrences of that sickness can be coated.

Plan at a look

- Any age restrictions: Full twist of fate and sickness protection should be bought prior to the puppy’s 15th birthday; afterwards, solely an accident-only coverage is to be had

- Effect of puppy age on top class will increase: Premiums get started expanding because of age to start with renewal

- Average price per 30 days: $40–60/month for canine, $20–35/month for cats

- Most commonplace explanation why a declare is denied: Pre-existing stipulations

- Average payout time: 10–15 days to procedure; repayment by way of direct deposit takes two trade days; by way of take a look at can take 10 trade days

- Dental coated? Dental injuries coated as much as the coverage prohibit; Dental diseases coated as much as $1,000Okay/12 months; Routine dental care, solely with further Wellness Rewards plan

- Alternative therapies coated? Yes

- Waiting duration for protection to take impact: Accident: Two days; Illnesses: 14 days; Orthopedic stipulations: Six months (canine solely, with an solution to scale back to 14 days with a vet examination to finish their Orthopedic Report Card)

- Free telehealth services and products introduced? Free 24/7 get right of entry to to PawSupport

- General wellness and/or annual assessments coated? Can acquire further Wellness Rewards plan

- Exam charges coated? Yes

- Senior, army, pupil reductions? Military: five%

- Lifetime most payout: No most

- Maximum annual payout: $30,000

- Multi-pet cut price? 10%

- Claims procedure: App

Best for Customer Service: ASPCA

Particularly effusive buyer evaluations and numerous customizable insurance policies make ASPCA Pet Health Insurance the most efficient pick out for customer support.

About the corporate

Crum and Forster, the company that gives ASPCA Pet Health Insurance, used to be based in 1997. They be offering accident-only and twist of fate and sickness plans, in addition to an non-compulsory wellness care plan in two variations that gives some protection for regimen care like dental cleanings and a few vaccinations. Deductible, annual prohibit, and repayment proportion are customizable.

What they get proper

While plenty of the corporations in our survey are praised for his or her customer support, the feedback about ASPCA appear specifically heartfelt, the usage of phrases like “friendliness,” informative,” and “kind.” One buyer mentioned, “They talk to you like a human with feelings and they always manage to make a rough situation better with just the kindness,” and others, “They truly make me feel like a valued customer” and “they won’t let you down.” They duvet hereditary and behavioral issues.

What units them aside

Prescription meals and dietary supplements to regard identified stipulations are coated underneath the elemental plan; maximum different plans exclude or prohibit protection for this or it’s only to be had as an add-on.

Plan at a look

- Any age restrictions: No

- Effect of puppy age on top class will increase: No particular resolution supplied; age is likely one of the components that determines top class price

- Average price per 30 days: The corporate didn’t supply a mean, however the common of asked pattern premiums used to be $22.90 for cats and $61.19 for canine

- Most commonplace explanation why a declare is denied: No resolution

- Average payout time: Within 10 days

- Dental coated? Optional protection to be had

- Alternative therapies coated? Some

- Waiting duration for protection to take impact: Base plan: 14 days; Preventive Care begins the day after the coverage efficient date

- Free telehealth services and products introduced? Yes

- General wellness and/or annual assessments coated? Optional protection to be had

- Exam charges coated? Yes

- Senior, army, pupil reductions? No

- Lifetime most payout: No most

- Maximum annual payout: Unlimited possibility to be had

- Multi-pet cut price? Yes

- Claims procedure: App

If You Cannot Afford Pet Insurance

Whether you could have insurance coverage or now not, don’t be afraid to speak about the price of remedy along with your vet. Being thinking about the associated fee doesn’t imply you don’t love your puppy! There is frequently a couple of imaginable remedy possibility for an issue, so if worth is a matter, let your vet know, so you’ll be able to speak about the entire possible choices. If your vet doesn’t make you’re feeling at ease about such conversations, you could need to believe discovering any other vet.

And talking of discovering a vet, the price of remedy can in truth range amongst vets even in the similar town. So at the side of no matter else you’re doing whilst you’re in search of a vet— whether or not it’s asking buddies for suggestions, studying evaluations, and so forth.—additionally name round and ask the costs of basic items you realize you’ll want, reminiscent of examination charges and vaccinations.

While few vets be offering their very own fee plans, some settle for CareCredit score, one of those bank card for veterinary care. You do wish to be licensed for this, as you possibly can with a typical bank card. The get advantages over a typical bank card, alternatively, is that underneath the proper instances—should you meet positive necessities and make your bills on time—you would possibly not pay any hobby.

You’ll once in a while see it steered that if you’ll be able to’t have enough money insurance coverage, you will have to spend money on a financial savings account for vet care. While this advice is well-meaning, the maths isn’t encouraging. The prices for some fundamental plans are so low that if you’ll be able to’t have enough money the ones per 30 days premiums, it’s not likely that you’ll want to put aside sufficient cash for a big sickness or harm. Of path it’s all the time a good suggestion to save lots of for a wet day—despite the fact that you do have insurance coverage, you’ll need to pay down your deductible prior to it kicks in. But should you’ve paid a 12 months’s price of, say, $20 premiums, it’s possible you’ll get much more than $240 in advantages. On the opposite hand, a 12 months’s price of $20 a month deposits in a financial savings account is not likely to earn sufficient hobby to be related.

If you’ll be able to’t have enough money vet deal with your puppy, take a look at along with your native humane society. Especially all the way through the pandemic, an increasing number of animal welfare organizations are putting in methods to lend a hand folks stay their pets within the face of monetary difficulties, spotting that a very powerful strategy to stay pets out of shelters is to lend a hand stay them with loving households that can be going via onerous instances. So they’ll be offering low cost care or be capable of refer you to a program that does.

Pet Insurance: Final Thoughts

Pet insurance coverage has come far within the ultimate couple of a long time, with extra firms within the trade and a greater variety of choices to make a choice from than ever prior to, and consumers appear in large part sure about its price. If you’re a long-time puppy proprietor who checked out puppy insurance coverage a while in the past and made up our minds towards it, it could be price reconsidering.

Vet care may be continuously advancing, providing extra therapies for critical stipulations, however those are solely an possibility if you’ll be able to have enough money them. More and extra, we really feel like pets are a part of the circle of relatives, so nobody needs to be within the place of euthanizing a puppy with a significant sickness which may be treatable. A just right, sparsely selected insurance coverage plan can stay you from discovering your self in that place. The just right information is, from the proof of our buyer survey and analysis, there are a selection of forged choices to make a choice from.

In addition to twist of fate and sickness protection, some plans now be offering protection for regimen care. Since regimen assessments and wellness care are predictable bills, surroundings apart the cheap for those is most likely enough for the general public. However, additionally as a result of they’re predictable, you’ll be able to simply do the maths to make a decision whether or not the extra price of a wellness plan works out for you financially.

*A survey carried out of two,000 US canine homeowners with puppy insurance coverage and 500 US canine homeowners with out puppy insurance coverage by way of Attest.

**Before publishing, we agreed to ship the taking part firms an unranked replica in their record for accuracy functions solely; this text displays that comments checked towards our personal analysis.